Subscribe for cutting-edge B2B tech research.

See Value Better

Spear is a fundamental asset manager focused on industrial technology. We help you do more than passively track the broader market.

Bubble or the next AI investment cycle? What we learned from Megacap earnings

It was a blowout week for tech — NVIDIA’s GTC set the tone, and the megacaps followed through with massive capex increases that signal this AI build-out is only accelerating. While many investors came into earnings worried about a bubble, the data suggests we may be just getting started.

“AWS is growing at a pace we haven’t seen since 2022 — reaccelerating to 20% YoY.” — Andy Jassy, Amazon CEO (3Q earnings call)

In this week’s edition, we break down the developments driving the next leg of AI infrastructure growth:

- NVIDIA: Setting the Stage for Tech Earnings

- Capex Boom: Cloud Titans Double Down

- Results Deep Dive: Amazon, Microsoft, Google

Our research digest is designed to keep you on the cutting edge of investments in data infrastructure, software, and cybersecurity.

This content is not intended as investment advice. Companies mentioned may or may not be holdings in our funds.

1️⃣ NVIDIA: Setting the Stage for Tech Earnings

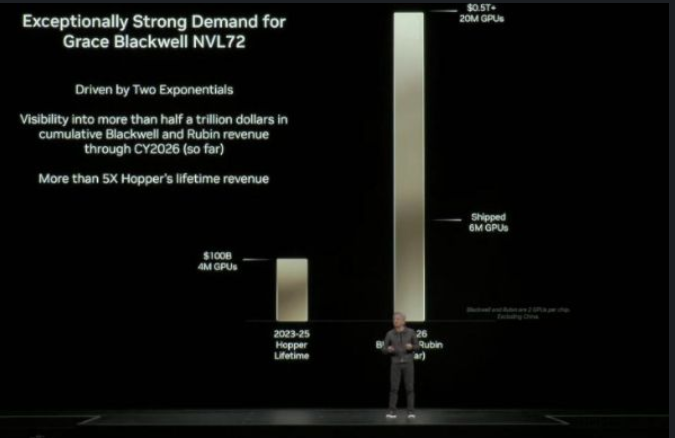

NVIDIA’s GTC updates were nothing short of explosive. Management guided toward $500B in revenues from Blackwell + Rubin through 2026, and we think even that might be conservative.

Key takeaways:

- Blackwell = 5x Hopper — Total Hopper sales were ~$100B while Nvidia’s current generation chip is expected to deliver $500B in sales, based on orders as of right now.

- Cost per GW and per token continue to decline. The cheaper compute gets, the more demand scales.

- Our math implies $700B for Blackwell — more on this ahead of Nvidia earnings.

Bottom line: We are far from a bubble. NVIDIA’s GTC comments essentially set the tone for this entire earnings season — and likely for tech into 2026.

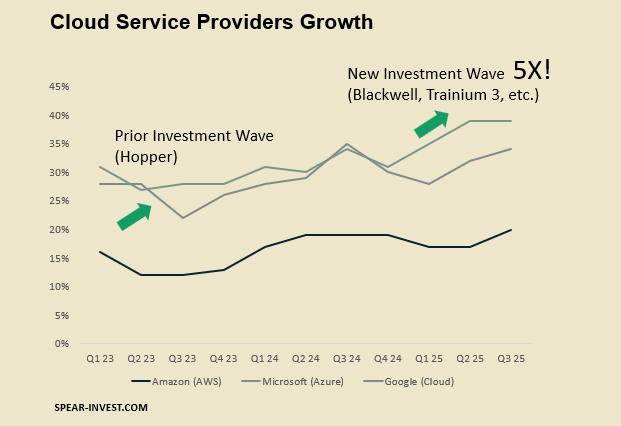

2️⃣ CAPEX BOOM: Cloud Titans Double Down

Every hyperscaler (Azure, AWS, Google, Meta) reported accelerating capex growth this quarter. While market reactions were mixed — Amazon and Google outperformed; Microsoft and Meta lagged — the common denominator was clear: spending is up and demand still exceeds supply.

Highlights:

- Capacity shortages now extend into 1H26, versus expectations of balance by 2H2

- Amazon’s Trainium chips are sold out, underscoring the sustained compute crunch.

- Based on equipment orders and permits, we see a 3-year visibility into continued capex acceleration.

Investor takeaway: The market is still building the infrastructure layer required to unlock the next wave of AI applications. Returns will follow — but only after this foundational build-out is complete.

3️⃣ Company Deep Dive

Amazon (AWS): Leading the Build-Out

- AWS growth: +20% YoY vs. 18% expected — a clear beat amid macro uncertainty.

- Infrastructure: +3.8 GW TTM, +1 GW expected in 4Q, and Project Rainier adding 2.2 GW once all 30 DCs go live.

- Backlog: October bookings eclipsed all of 3Q’s total deal volume — visibility is strong into 2025.😮

- Trainium2: +150% QoQ growth → now a multi-billion-dollar business ahead of the T3 launch.🚀

Microsoft (Azure): Growth Meets Constraint

- Azure growth: +39% YoY, largely in line with expectations post recent OpenAI-related deals. Capex revised ⬆️

- Capacity constraints: Limiting short-term upside — outlook affected by supply constraints by ~200 bps.

- Focus is shifting to returns on AI investments and growth in applications (e.g., Copilot) vs. raw compute capacity. Still early innings and more to come in ’26.

Google Cloud: Execution and Monetization

- Growth: +29% YoY — impressive given the tough 3Q comp.

- Profitability: Continued operating margin expansion despite elevated AI infrastructure spend.

- AI monetization: Early traction in Vertex AI and Gemini integration across Workspace; signs of AI-driven lift in ad targeting efficiency.

- Customer demand: Enterprise AI and data analytics deals scaling; notable momentum from startups and mid-market customers deploying GenAI use cases.

💡 Big Picture:

We’re entering the next phase of the AI infrastructure cycle — one defined by massive investment, declining unit costs, and widening adoption curves. With supply still chasing demand, the setup into 2026 remains structurally bullish for compute, capex, and cloud infrastructure.